Last Updated on December 3, 2020 by admin

When running Google Ads campaigns in competitive keyword environments, it is always important to keep an eye on those competing for the same search result real estate. While evaluating competitor ad copy, offers, and extensions, their positioning is also critical. Depending on the keywords that you are bidding on, search ad positioning can widely vary. Even with the Google Ad Preview Tool, it is hard to keep refreshing to see how you are coming up in your auction bids. Additionally, it is unhealthy for your click-through rate and impression share to keep refreshing your searches for specific keywords to see if you are coming up on top. This can be an issue with overzealous clients from time to time.

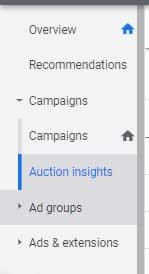

So, how do you determine how your campaigns and ad groups are doing against the competition for search eye share? Google Ads has a very nice tool called Auction Insights to track this. to track this. It is located under the Campaigns Main Tab under the Campaigns menu label.

Clicking on this, you will see your performance against a list of main players that are competing in the same keyword space. Across the top, you will see a variety of position metrics. These are critical to use, along with your own impression share, top impression share and absolute impression share metrics that are found at the campaign, ad group and keyword level.

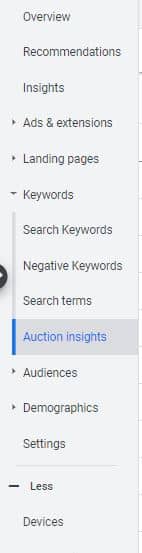

It is important to view these at an aggregate campaign level, but it is even more critical to view these at the ad group level. This will give you the real granular auction and advertiser data you need:

Now, some definitions here are critical. If you hover over the column header, you will see the official definition from Google Ads, which I think are well done and very straightforward. But to put these in terms for us to use to our advantage:

Impression share: This an internal metric that shows the number of times your ad was shown versus the number of times it could have or was eligible to show. Factors here include ad quality, the auction at the time of the query, and your daily budget.

Overlap rate: This is probably one of the most important metrics when evaluating your competitors. This shows how often your search ad ran up against a competitor search ad. This helps you identify the frequency of which you were going “head to head” in the auction with this specific competitor.

Position above rate: This gives you intelligence on how often a competitor came up higher than you in the block of search ads in the same auction. This, along with your impression share metrics, can help you gauge how effective your bids are if you are using manual CPC bidding.

Top of page rate: This percentage shows time in an auction during the set time period that you showed up on the top of the paid search results. As you look at your competitor data, note that these numbers are not directly related to you, but what their respective top of page what was.

Absolute top of page rate: Using the same perspective, this data for you and your competitors shows the percentage of times that your ad showed at the very top of all search results, including organic.

Both the top of page rate and the absolute top of page rates are very good gauges of your search ad’s visibility and performance. Additionally, you can track how effectively your competition is showing up on the top of the SERP within the keywords and auctions that you are bidding on.

Outranking share: Now this stat is a bit more nebulous and has to do with ad rank. Basically, take this data into context with the other data sets to see how often you are showing up when a competitor is not.

How to use this data? Keep in mind, so many factors play into whether ads show for you. The auction, your bid and bid settings, your budget, the time of day, your quality score and ad rank, and various keyword factors as well. But this data will give you context on who is coming after your search share and how effective they are in a given time frame. I have had a few instances lately where showing this data to a client alerted them to new competitors in the marketplace that they were either unaware of or didn’t think were savvy enough to take search share.

While it is a lot of data to sort through, the Auction Insights tool in Google Ads can be a very good index of where you are positioning consistently against other advertisers and competitors in a given time frame. If you are using manual bids, trying to decide how much to raise (or lower) bids is constantly a challenge. Plus, Google doesn’t give much guidance here as they are trying to phase our manual bids. Using your own impression share, top impression share and absolute share metrics will provide guidance here. But also, paying attention to the top of page rate, overlap rate and position above rate gives you a great insight on how you are positioning in search results.

Also, I am not discounting the huge importance of your quality score, ad rank, and click-through rate, which can be more important than your actual bid strategy, depending on the keyword. You can also use Auction Insights to evaluate these things, such as competitor ad copy and also competitor landing pages. Note: DO NOT click on your competitor ads directly in paid search results, that is poor taste. Pay attention to those advertisers coming up ahead of you in the overlap and position above rates, noting that of course there is no way to know what type of bid strategy or setting they are employing.

While there are some good paid tools out there for high-level PPC competitor data, such as SpyFu and SEMRush, Auction Insights in Google Ads provides great free insights for you to use to your benefit.

Leave a Reply